What’s the best way to trade crypto? Should you HODL? Should you buy and sell after a few hours? Should you swing trade?

Cryptocurrency is one of the best assets for momentum traders. It is liquid, it has range, and provides clean trends consistently.

The truth is there is no one-size-fits-all strategy for crypto investing.

Here’s what you need to consider about these two styles of investing:

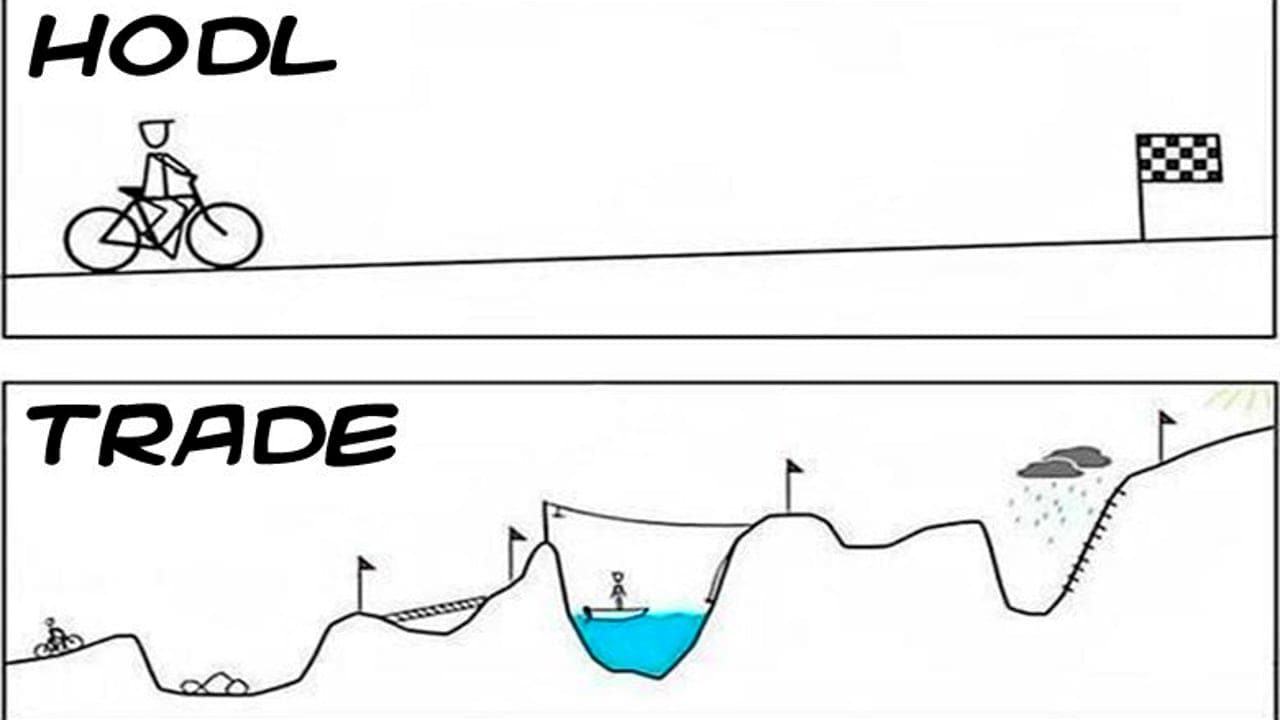

Momentum Trading vs Investing

There are many ways to skin a cat. It al depends on the trader. Momentum trading is our preferred style of trading Bulls on Wall Street. Momentum trading simply refers to day trading and swing trading.

Day trading is buying an asset and selling it within the same trading day. A swing trading is buying and selling a few days or weeks later. The fundamental differences between these two styles:

Momentum Trading

- Holding period from seconds to a few weeks

- Higher risk, higher reward

- Focused on Technical Analysis

- Focused on Capital Growth

- Capitalize in Both Market Directions

Long-Term Investing

- Holding Period From Years to Decades

- Lower Risk, Lower Reward

- Focused on Fundamental Analysis

- Focused on Capital Preservation

- Long side Biased

Let’s get into the pros and cons of using each style of investing on it:

Momentum Trading Pros

Momentum trading, if done correctly can make you huge percentage returns in a matter of minutes or hours. Crypto has had such a large range lately that it is possible to make 5-10% returns in a day with the right entries and exits.

You are constantly taking profits, unlike with long-term investing, you are creating cash flow on a weekly basis. As momentum traders, we look for the coins with the most range, liquidity, and in the best position to make explosive moves.

Momentum Trading Cons

Crypto has the potential to do some serious damage to your trading account if you don’t have proper risk management. When you’re trading volatile asset classes like cryptocurrencies, you have to have a trading plan. Always use a hard stop loss.

You also have to take the time to develop a successful trading system for cryptocurrencies. You need to have an edge, otherwise, you’re just gambling (you can learn some strategies in Bulls on Wallstreet free E Book here).

It also requires active management of your positions. Some people don’t want to be monitoring positions consistently. Buy and forget.

Buy and Hold Pros

It is the most passive form of investing. You don’t need to be checking quotes every day, and for this reason, it is the most popular. Bitcoin and the general market has been in a non-stop uptrend for the past year, and all the fundamentals are there for continued growth in upcoming years. It is the most hands-off style of investing.

Buy and Hold Cons

Most “Buy and Hold” investments people usually make 2-6% returns annually, which is considered very good. Bitcoin, Ethereum, and most other cryptos obviously have achieved much better returns for investors in the past few years.

Volatility is not something most “buy and hold” investors want and might cause them a lot of stress. Bitcoin can make 10% moves in a day, it can also drop 10% or more in the same time period. It might cause people who aren’t experienced investors to do something rash and panic sell.

Know What Type of Trader You Are

Everyone has different amounts of capital at their disposal, different risk tolerances, and different personalities. This means pretty much everyone will have their own unique style of trading. If you’re the type of person who feels the need to check their phone every 5 minutes to see how their Bitcoin investment is doing, you might consider day trading instead of buy and hold.

If you’re a person who is not quick thinking and gets stressed out by watching every tick, buy and hold might be better than day trading for you. It is important to understand yourself, and what in trading causes you the most pain. Regardless of your style of investing, you need to take the time to develop a trading system that causes you the least amount of stress.

The bottom line, if you can stomach risk and execute a strategy profitably, momentum trading is clearly the superior option. Long-term investing = Lower risk, lower reward. Momentum trading is a higher reward, and not necessarily high risk if you know what you’re doing.

Thank you very much for this informative blog post! I am more like a momentum trader and want to see where I stand now. Not what my investment may pay (or loose) after 5 years…

LikeLike